Social security delayed retirement calculator

The table below shows the delayed retirement credit by year of. This year we saw a much higher than normal cost-of-living adjustment.

When Can I Retire This Formula Will Help You Know Sofi

Social Security Administration.

. Delayed retirement credits increase a retirees benefits. If you enter income from other sources such as Social Security or pensions that income will be deducted from the desired income when making the investment calculations. By delaying John increased his monthly Social Security.

Whats the maximum monthly Social Security benefit. Benefits for Spouses Calculator. This Social Security break even calculator helps answer the question.

The calculator below gives you the amount with all credits applied for comparison purposes. 2021 Social Security Changes Page 2. If you want to reach a.

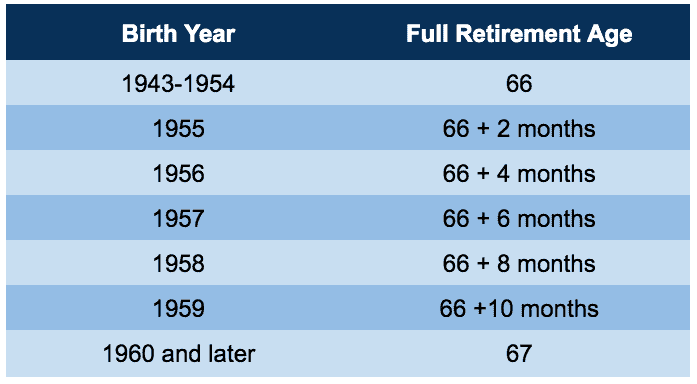

Full retirement age or FRA is the age when you are entitled to 100 percent of your Social Security benefits which are determined by your lifetime earningsIt is gradually increasing from 66 and 4 months for people born in 1956 to 66 and 6 months for those born in 1957 and ultimately 67 for people born in 1960 or later. You can apply four months before you want your Social Security retirement benefits to start. Use our Social Security Full Retirement Age calculator to pin it down If you take benefits before FRA your benefits will be reduced.

Income Taxes and Your Social Security Benefits Social Security Administration. Your PIA is the standard amount you. For every month from your FRA until age 70 that you.

From full retirement age until 70 you can earn delayed retirement credits. If a worker delays receiving Social Security retirement benefits until after they reach full retirement age. If you need further assistance call us at 1-800-772-1213 or you can contact your local Social Security office.

For a worker claiming Social Security in 2022 at full retirement age the highest monthly amount is 3345. This will enable you to earn delayed-retirement credits. SSA also provides a life expectancy calculator to help with retirement planning.

At 70 you will get the maximum amount of benefits that you can get from Social Security. It does not make sense to delay your Social Security retirement age past 70 because your benefit amount will not increase. Once youre ready to apply the easiest way to complete your application is online.

While we may notice how much we kick in 18228 for me as a self-employed individual in 2022 those of us planning to retire early tend to largely ignore it when calculating safe withdrawal rates and our annual cashflow. Or stated another way both the chart and the retirement schedule consider only your investment plan and income before Social Security and pensions. For example your FRA is 67.

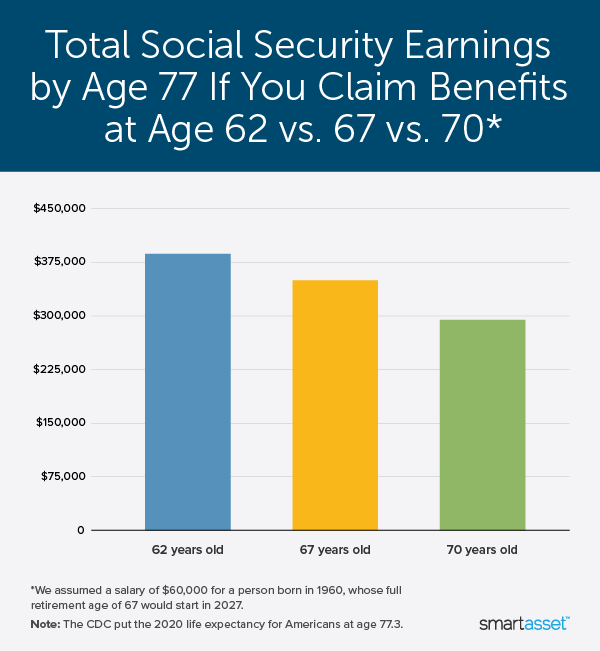

Delaying retirement past FRA results in delayed retirement credits which increases SS benefits by a certain percentage up until the age of 70. This is an increase of about 6 from the payments in 2021. Over your lifetime which filing age will net you the highest total payments from Social Security.

Social Security beneficiaries who are between full retirement age and age 70 can suspend Social Security payments and earn delayed retirement credits. If you earned 55000 Social Security would withhold 1 for every 3 you earned above the limit. Hi Matt Since you turned 62 after January 1 2022 you wont receive the upcoming 59 cost of living COLA increase no matter when you start drawing your Social Security retirement benefits.

These boost your eventual benefit by two-thirds of 1 percent for each month of delay and increase survivor benefits for your spouse if you die first. Waiting until 70 to begin your Social Security if you are married and are. Delayed retirement credits are the financial reward Social Security gives you for putting off claiming your retirement benefit.

Hi James thanks for using our blog to ask your question. So on your 55000 earnings youd lose about 2133 or 178 per month leading up to the month you reach normal retirement age. To draw the top benefit your earnings must have exceeded Social Securitys maximum taxable income the.

Learn how your earnings may affect your benefit payments if you are currently working and are eligible for retirement or survivors benefits this year. Your first social security check will be delayed for several months the first check may be only a fraction of the full amount. If you earned 55000 Social Security would withhold 1 for every 3 you earned above the limit.

Full retirement age FRA is the age at which you can claim your standard Social Security benefit or your primary insurance amount PIA from Social Security. This is because the consumer price index saw inflation soaring and the cost of goods. You can elect to receive Social Security benefits starting at age 62 or as late as age 70 though your full retirement age FRA depends on the year when you were born.

This will increase your benefit by 8 for. Credits start accumulating the month you hit your full retirement age or FRA which is 66 and 4 months for people born in 1956 and is gradually rising to 67 for people born in 1960 or later. You can also learn about.

Your Social Security Statement offers a much more comprehensive and useful view into your future retirement benefits. Thats about double the average retirement benefit 1666 in April 2022. If you are unsure about your numbers just call the SSA and ask.

Compute the effect on your benefit amount if you file for early or delayed retirement benefits. To obtain your statement you must set up a free online. Average Social Security Checks For 2022.

The Quick Calculator lets you plug in your date of birth SSN and anticipated year of retirement to get an estimate of your monthly Social Security retirement benefit. Social Security is something we aspiring retirees dont spend much time talking about. If you retire before age 70 some of your delayed retirement credits will not be applied until the January after you start benefits.

Regardless of when you claim Social Security benefits the sign-up age for Medicare is still 65. After 70 further delaying retirement. Those dates apply to the retirement benefits.

As of January 2022 the average Social Security retirement benefit is 1657 per month. Youll find answers on the key factors that shape your benefits from early-filing penalties and delayed retirement credits to cost-of-living adjustments and Medicare premium deductions. Early or Late Retirement Calculator.

Free Social Security calculator to find the best age to start SS benefits or to compare the differences between starting SS at different ages in the US. This section of the AARP Social Security Resource Center dives into core questions you face as you approach your retirement years. By the time John claims his Social Security benefit at 69 his monthly payout will be 1840 1227 of his full retirement-age benefit.

Or you can wait until age 70 and thereby earn a 32 percent bonus over your PIA from delayed retirement credits of 8 percent a year. As an example if your PIA worked out at 1000 it would be discounted down to 750 if you took benefits at the earliest possible age 62. Wait and Accumulate Delayed Retirement Credits.

AARP Social Security Calculator. The easiest way is to simply subtract 6667 per month that youve delayed beyond your full retirement age. If you decided to go for.

Will Social Security Still Be There When We Need It Most Likely Social Security Retirement Savings Plan Retirement Savings Chart

How Early Retirement Reduces Projected Social Security Benefits

Delaying Social Security Retirement Benefits Simplywise

This Chart Shows Why You Shouldn T Wait To Claim Social Security

1

Savvy Social Security Planning

What Age Should You Claim Social Security Goodlife

How To Calculate Your Retirement Benefits How To Calculate Your Retirement Benefits By Social Security Administration Facebook

Social Security

This Chart Shows Why You Shouldn T Wait To Claim Social Security

Delaying Social Security Retirement Benefits Simplywise

1

Breaking Down Social Security Retirement Benefits By Age Simplywise

1

Social Security Age Of Retirement Specific To Birth Year Social Security Intelligence

Did You Know The Social Security Website Now Offers A Retirement Calculator Financial Alternatives

Social Security Full Retirement Age Increases Past 66